|

Riba (Usury, or Interest)

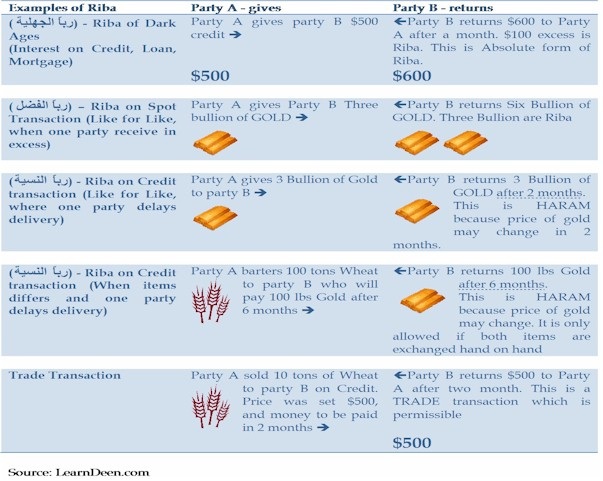

Riba is the practice by which fees (or interest) are attached to loans. Riba is not limited only to money, but also includes all transactions in which the debtor returns a sum of goods in excess or above the original agreed transaction, be it money, commodity, or any other item or goods or services. Also, anything in excess of the original agreement is considered riba if items exchanged are of the same kind, such as gold for gold (see photo at bottom of page).

Islamic jurisprudence considers Riba a tool of oppression and a means to unjustly take others' money by exploiting their needs and circumstances. Riba is a method used by those with wealth and power for hoarding money. Allah (SWT) forbid a Riba-based system altogether and commanded charity as an means to distribute wealth more fairly.

Islam warns against those who accumulate wealth through this unjust practice. There are many references in Qur’an regarding the prohibition of Riba:

Qur’an 3:130 says (translation):

“O ye who believe! Devour not usury, doubling and quadrupling (the sum lent). Observe your duty to Allah, that ye may be successful.”

Also, in Qur’an 2:275-280 Allah says:

“As for him who returneth (to usury) - Such are rightful owners of the Fire. They will abide therein. Allah hath blighted usury and made almsgiving fruitful. Allah loveth not the impious and guilty. Lo! those who believe and do good works and establish worship and pay the poor-due, their reward is with their Lord and there shall no fear come upon them neither shall they grieve. O ye who believe! Observe your duty to Allah, and give up what remaineth (due to you) from usury, if ye are (in truth) believers. And if ye do not, then be warned of war (against you) from Allah and His messenger. And if ye repent, then ye have your principal (without interest). Wrong not, and ye shall not be wronged. And if the debtor is in straitened circumstances, then (let there be) postponement to (the time of) ease; and that ye remit the debt as almsgiving would be better for you if ye did not know.”

From these verses, we know that Muslims must be proactive and take mindful steps to not deal in Riba, and fear Allah (SWT) in this regard considering the serious and grave consequences.

Riba is commonly practiced in the following examples (but not limited to these alone):

Also be careful:

As a Muslim, you must be aware of usury and its forms and take steps to avoid it.

Hadiths Related to Usury:

Islamic jurisprudence considers Riba a tool of oppression and a means to unjustly take others' money by exploiting their needs and circumstances. Riba is a method used by those with wealth and power for hoarding money. Allah (SWT) forbid a Riba-based system altogether and commanded charity as an means to distribute wealth more fairly.

Islam warns against those who accumulate wealth through this unjust practice. There are many references in Qur’an regarding the prohibition of Riba:

Qur’an 3:130 says (translation):

“O ye who believe! Devour not usury, doubling and quadrupling (the sum lent). Observe your duty to Allah, that ye may be successful.”

“As for him who returneth (to usury) - Such are rightful owners of the Fire. They will abide therein. Allah hath blighted usury and made almsgiving fruitful. Allah loveth not the impious and guilty. Lo! those who believe and do good works and establish worship and pay the poor-due, their reward is with their Lord and there shall no fear come upon them neither shall they grieve. O ye who believe! Observe your duty to Allah, and give up what remaineth (due to you) from usury, if ye are (in truth) believers. And if ye do not, then be warned of war (against you) from Allah and His messenger. And if ye repent, then ye have your principal (without interest). Wrong not, and ye shall not be wronged. And if the debtor is in straitened circumstances, then (let there be) postponement to (the time of) ease; and that ye remit the debt as almsgiving would be better for you if ye did not know.”

From these verses, we know that Muslims must be proactive and take mindful steps to not deal in Riba, and fear Allah (SWT) in this regard considering the serious and grave consequences.

Riba is commonly practiced in the following examples (but not limited to these alone):

- one's livelihood, such as in banking;

- credit cards;

- taking loans and paying interest to a financier;

- accepting interest as in personal investments,

- bank accounts, CD's (Certificate of Deposit)

- government bonds, etc.

- that your livelihood would not get benefit from institutions which deal in riba (for example, receiving sponsorship from a riba-based institution), and

- when making investments in stocks, being sure they meet Islamic standards. Mutual funds are a serious difficulty because brokers pick and choose the investments and are at liberty to change their allocations without your authority. Your investments could be subject to support of non-halal stocks, therefore do careful research.

As a Muslim, you must be aware of usury and its forms and take steps to avoid it.

Hadiths Related to Usury:

- "The Prophet (SAW) said: May Allah curse him who eats of usury (riba) or feeds it to another.” [Sahih Muslim]

- “The Prophet (SAW) cursed whoever eats of riba, feeds another with it, writes an agreement involving it, or acts as a witness to it.” [Sahih Muslim]

- Reported by Abdullah ibn Mas’ud: The Messenger of Allah (SAW) said, “Adultery and usury do not become widespread among a people except that there will descend upon them the punishment of Allah the Exalted.” Source: Sahih Ibn Hibban 4502

- The Prophet (SAW) said, “Usury and adultery do not become widespread among a people except that they will become vulnerable to the punishment of Allah the Exalted.”

- In the Prophet's (SAW) farewell speech he said: "God has forbidden you to take Riba, therefore all riba obligation shall henceforth be waived. Your capital, however, is yours to keep. You will neither inflict nor suffer inequity. God has judged that there shall be no riba and that all the riba due to `Abbas ibn `Abd al Muttalib shall henceforth be waived."

*See More Resources under the Finances category for some businesses which meet Islamic standards with regard to personal finances. for more information on the subject of riba.